05 March 2020

Capture planning is the process of deciding to BID or not, and working out HOW you will win. It is particularly important when participating in large (billion dollar) competitive bidding.

The aim of capture planning is to improve win/loss ratios on competitive bids

The key method of improving win/loss ratios is to stop bidding on low-win-probability projects. Capture planning is a formalized process for making an informed decision.

The natural instinct is to bid on anything that moves, however long term success requires a more astute approach. Bidding is expensive.

Meeting with potential customers to discuss the opportunity, evaluating the opportunity, designing a solution, developing a bid strategy, costing the bid, and writing a proposal document saps internal resources that might be better used on higher quality opportunities. Of course, this needs to be balanced against how desperate you are for work.

And chasing multiple opportunities is limited by your business development resources.

Consequently, best practice is to undertake an assessment process before proceeding with bidding aimed at evaluating the suitability of any new opportunity with respect to the capabilities of your firm, estimating the chances of winning the project, and formulating a bid strategy. This process is called capture planning.

You need to assess your chances of winning before committing resources to bidding.

Many firms will not submit bids unless they assess their chances of winning as being much better than average (i.e. better than 1 divided by the number of bidders). However, making this assessment requires a formal process to ensure the conclusion is based on evidence and not just gut feel.

The Capture Plan therefore is both a decision making tool but importantly, should the decision be to proceed, the capture plan provides the bid team with a detailed description of the bid strategy (how to win).

Origin of capture planning

The term came out of very large contracting from organizations primarily focused on U.S. Department of Defense opportunities. Possibly first used in the 1980's but has gained wider use since the nineties.

However, the broad principle of assessing "what are our chances?" before commencing a bid, is common sense.

...and while vital when bidding for BIG projects, some form of capture planning, even if only 'back of the envelope', should be used to prioritize which bids you will work on next, and which may be discontinued.

The extent of work put into capture planning is driven by the size of the opportunity. Large contracting firms typically have mature, formally documented capture planning processes submitted to senior levels for approval.

The capture plan typically includes...

- A description of the opportunity

- An estimated value of the opportunity

- Project timing (when do they want it?)

- Fit with organizational capabilities (does the work type and scope fit)

- Fit with organizational capacities (will we have enough capacity to bid and deliver when awarded the contract)

- List of likely competitors also pitching and their strengths/weaknesses on this deal

- Probability of winning

- Risk assessment

- A detailed evaluation describing the reasoning for the decision

- The bid strategy (how will we win?)

- A cost estimate for bidding

- Recommendation Proceeding to bid or Declining to bid

When reading about the awarding of a big contract to a competitor in the news , the capture plan provides the board (or senior management) with the answer to the question "did we know about this project? Did we bid for this?"

"Yes, we did. And we rejected the opportunity and here is why."

Without the documented capture plan, it might be assumed that the business development team were asleep at the wheel.

Capture planning levels

There are no hard and fast rules. Every organisation develops its own approach to capture planning. The following is a rough guide to illustrate that different sizes of opportunity justify different approaches. You need to be sensible about applying the capture planning methodology, as the capture planning process itself also requires work...

-

Very large projects: Typically, Multi-Million/Billion dollar projects. Client has a buying team. Long sales cycles (months or years). A detailed and sophisticated approach to capture planning would be employed. These projects are typically infrastructure, engineering or Defence fighting platform projects (Ships, Aircraft, Submarines, Land based vehicles, Radar systems etc.)

-

Large projects: High hundred's of thousands to low millions: Client has multiple people involved in decision making. Sales cycle generally within a year. A briefer version of the capture planning process would be employed, however still with a formal review process.

-

Small Projects: Quite often not referred to as "capture planning" however, applying the same process and thinking in a cut-down formalized (checklist) manner should be applied.

Clearly, organizations should adapt the following principles based on opportunity size, complexity, time available, and importance of the opportunity to your organization.

The capture plan is the first filter designed to eliminate projects that are not suitable, before too many resources are wasted.

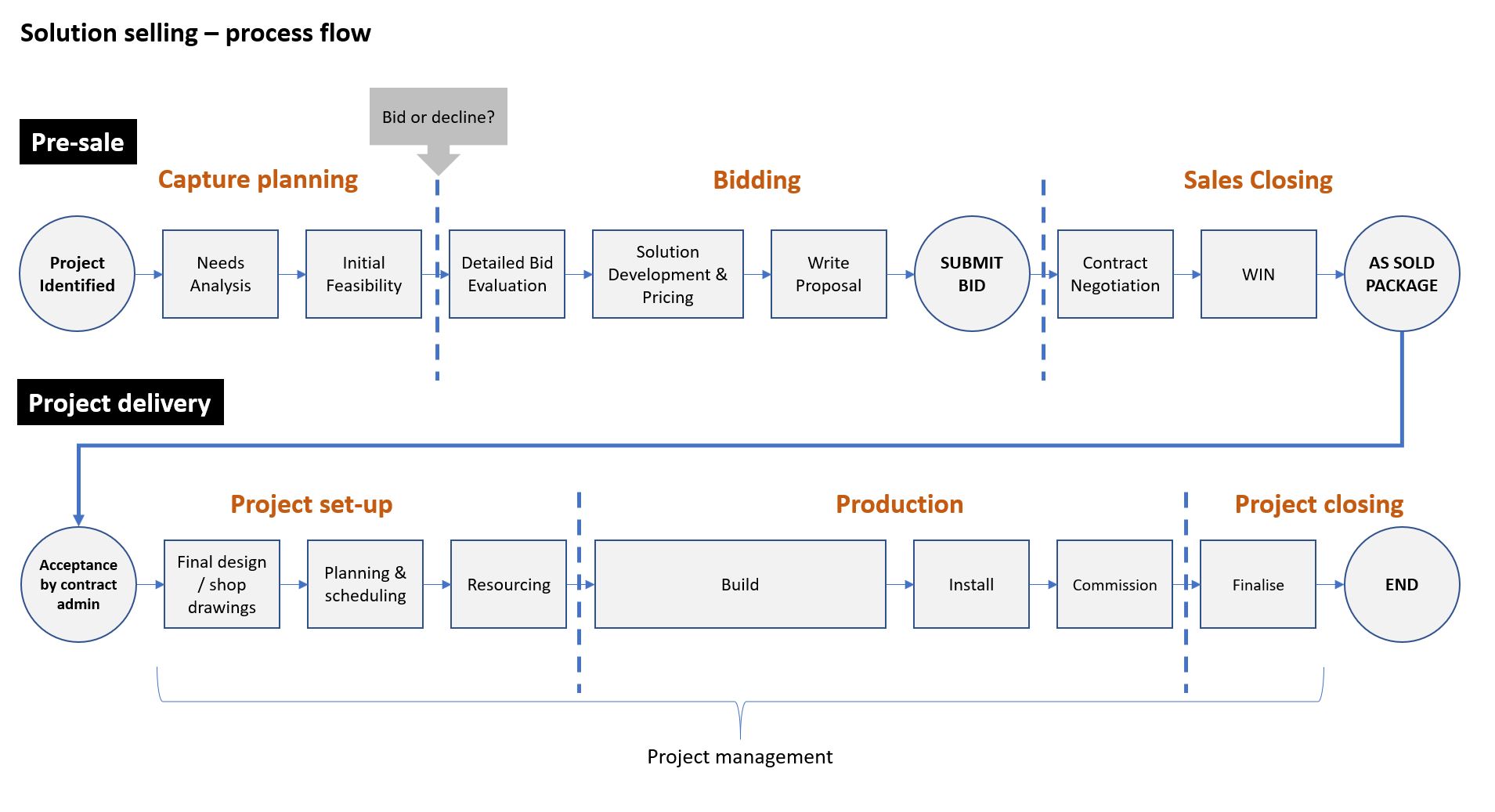

Capture planning is the first stage in the solution selling process. Capture planning comprises three steps Project Identification, Needs Analysis, and Project Feasibility.

Capture Planning/Project identification

"PROJECT IDENTIFICATION" can also be substituted with "ENQUIRY" - opportunities are either identified by the solution selling firm or start as enquiries.

You found them: If your business development processes are good, you will have your "ear to the ground" and identify opportunities before a tender specification is drawn-up. Capture Planning starts here, however the process isn't begun in earnest until you have at least had a face-to-face meeting with the potential client to qualify the opportunity.

They found you: While enquiries are always welcomed, you are already behind if the first you hear about the opportunity is when you are contacted by the potential client. Your opposition may (but not always) already be talking to them. However, you press on with the capture planning process. Hopefully, they will not have drafted a specification.

During project (or 'opportunity') identification, information is gathered about the project and the key people involved are identified.

Capture Planning/Needs analysis

In solution selling, the needs analysis is a fundamental process, and a foundation to the bid. While this might seem obvious, many project opportunities start out as broad concepts where details can't and aren't determined. This is both an opportunity and a trap as will become clear later.

However, many project opportunities begin as fishing expeditions where the customer is still evaluating, formulating, gathering information, working out what is possible, what is feasible. The best and lowest cost (free) resource they have is to talk to solution providers. The danger is the solution providers may invest hundreds of hours working on a proposed solution thinking they know what the custom wants without actually thoroughly testing the proposition and asking the customer to sign-off.

This is part art and science. The sales approach is to develop a bid based on "let's knock their socks off" - hoping to blow them away with a brilliant solution.

The needs analysis is the process of accurately defining what the customer is asking for, and sometimes identifying potential differentiation "what they want, and what they need and what they can afford" might be different, and sometimes these are three vectors that never intersect in euclidean space.

Some briefs are received verbally. The discipline of converting these discussions into a document "our understanding of the brief" and confirming with the client is a tool that can be used to test you are on the same page. Some clients go weak at the knees when presented with a written version of a verbal brief; best to find out early they aren't serious.

Before moving forward it is essential to settle on an accurate requirements specification.

Many organisations position themselves for bid success by collaborating with customers to develop the requirements specification, thus steering the specification to favour their firm and developing a business relationship early.

The Needs Analysis stage is an opportunity to identify potential ways to differentiate your bid. Indeed, meeting with the client to discuss the specification often identifies further requirements, ideas for improving the specification, or a potential non-conforming (alternate) bid.

Sloppy needs analysis can generate considerable rework. For example, starting work on solution development before the requirements have been fully identified.

Conversely, sometimes some design work is needed to determine feasibility.

Capture Planning/Initial Project feasibility

Determine if the opportunity is really suitable for the organisation. Solution sales organisations must focus on core business and eschew the tendency to think "we could build that" when presented with an opportunity outside of normal capabilities. This concept is discussed in detail here What cycling teaches you about business.

Easier said than done; we've all experienced it. The sales pipeline is not as full as it should be, and the need to pull on a new project is becoming urgent. However, invariably it seems as soon as we capture a difficult project outside of our comfort zone, a better opportunity more suited to our business comes into view. This is the reality of managing a project based business.

The cure is to ensure the sales opportunity pipeline has qualified opportunities coming down the line - that's called B2B marketing.

The project feasibility stage is about applying filters to the opportunity to eliminate projects that are not suitable.

As soon as you have identified a show stopper, reject the opportunity.

Typical filters are...

- Project value: Make a rough order of magnitude (ROM) estimate of the project value. The project value drives the level of detail necessary (investment of time) for each of the following steps. I always find comparing the final bid price with your initial estimate is a good reality check. Most organisations know the price range within which they are competitive. Best practice is to build a file of past project final costs that be related to a broad measure like square metres, service points, tonnage etc. It's amazing how often despite nickel and diming every screw in a giant spreadsheet - the final price is not far off the broad measure.

- Do we have the capability? Some projects are simply outside of the firm's capability. You could do it, but not at a competitive price; you will either waste time bidding or have to submit a skinny price. If you are not desperate for the work - best to walk away.

- Domain risk: Working outside of familiar territory has risk. For example, if you normally work in the water industry, being ask to quote on a project for the oil and gas industry; there may be assumed knowledge that you are not aware of.

- Do we have the capacity? If your order book is full and their required delivery time frame cannot be met, determine if the customer is flexible on delivery. Can you gear-up or outsource to obtain extra capacity? Capacity includes bidding capacity; unless you want to employ a cast of thousands in your design and estimating team, make sure you are only bidding on quality opportunities.

- Is the project real? Some clients engage with solution selling organisations to conduct their project feasibility, asking firms to do the work for them to either work-up design ideas or simply to obtain pricing scope. They will use this information to decide to proceed with a project, allocate budget, improve their requirements specification, and use it for conducting a genuine RFP (request for proposal) later. They may or may not tell you that this is what they are doing. This happens in architecture all the time where firms spend months developing concepts for developers which fail at financial feasibility (might also be because developers want a square featureless box and architects are hell-bent on adding bells and whistles).

- Do they have the budget? Exploring price expectations early is important. If their requirements spec is likely to exceed their budget it will either mean wasting time bidding or the outright cancellation of the request for proposals.

- Do they really need custom build? Be particularly wary when the customer has the option of an out-of-the-box solution verses custom build, which is often the case in the software development industry. The key question is "why do they need a custom build?" - even if the client initially seems committed to custom-build, over the course of exploring their options, if they don't need it - there is a high probability they will eventually come to their senses, but often only after you have invested a lot of time chasing a ghost. This is where identifying and engaging with all members of the customer's "buying team" is important. The finance person may well have a more pragmatic view than the project champion.

- Are you talking to the decision makers? Many a bid has progressed to conclusion only for the bidders to later learn the project was never endorsed at high-level, it was a pet project instigated by an internal team that had hopes of pushing it through, or had simply exceeded their pay-grade. You may still decide to proceed with the bid, however you need to understand the risk.

- Technical risk: Are there gaps in the specification, unresolved requirements, risky technologies, and will you be dependent on uncontrollable third parties (for example other contractors)? Technical risk also speaks to the degree of innovation required. Sometimes its possible to transfer the risk to the client, however large corporates for example, are notorious for specifying hard deadlines (with liquidated damages) despite uncontrollable risks - "do you want the work or not?"

- Financial risk: Does the client have the capacity to pay? Are they imposing liquidated damages for late delivery? Is there a large bank guarantee required? Do we have the balance sheet strength to fund the project between progress payments?

- Safety and environmental risk: Are there any aspects of the project that could put people at risk and what is the potential environmental damage that might occur if things go wrong?

- Culture and reputation risk Are these people you can work with? Ask around, what is their reputation? Search their ABN and company names (including associated entities and directors) - are there any past litigation proceedings, insolvency events or other warning signs? Some companies are notoriously litigious and lawyer-up at the first sign of trouble; playing that game takes the fun out of business.

- Political risk Some proposed projects will notoriously face community, environmental, or cultural opposition. Doing substantial proposal work in support of a project destined to never be given government approval is not good business. Of course, this is often a grey area. Your capture planning checklist should include a process to assess political risk.

- Informal tariffs A polite term for bribery and corruption. In some countries bribery is an accepted part of business. More than one company has come unstuck not understanding how this works.

- Divine intervention Another polite term for when a contract is awarded to a bidder based on some political or other relationship because a very high-up and highly influential person sailed in at the eleventh hour and changed the outcome. With homework, sometimes you can identify this possibility.

What are our chances? A key part of the feasibility is to determine the likelihood of winning the project...

- How strong is our reputation and relationship with the customer? There is big difference between quoting for a project where you have a long standing relationship with a customer versus not. So, if this is your first time quoting to a new customer you need to work doubly hard to build a relationship and assess the attitudes and positions of the people comprising the buying team.

Of course, the reality is MANY potential projects are also new customers; likely you will not have dealt with any of the people on the buying team before.

The capture plan also describes the strategy for building a strong relationship during the needs analysis and solution development phases

- Have we identified all members of the buying team and their hot-buttons? A key mistake in strategic selling is not understanding who all the players are. Buying teams comprise people having differing buying roles: Technical, Financial, End-user, and Procurement. There may also be external advisers involved who can sometimes be very influential. Each of these people may have biases and allegiances toward particular technical solutions, technology platforms, and competing vendors. They may also have prejudices ("I'll never work with those guys again, they stiffed me when I was working for..."). Good capture planning process is to deeply identify all people involved in assessing the bid and understanding the extent to which they can influence the outcomes and their point of view.

- Who else is bidding? Clearly it is important to identify who else is bidding, but finding out is often hard. As a starting point you could just ask. Usually you can guess who the usual suspects are. Sometimes you are the only ones being asked (not uncommon, particularly if your capability is unique). A strong relationship with the customer (or at least one person) will help.

- How do we compare to the likely competitors? A formal assessment of the competitors looking at how you rank against each on important attributes and criteria should be 'exhibit A' in a capture plan.

- Are we just making-up the numbers? Client procurement policies often mean obtaining minimum three bids. It's not uncommon for one of the bidders to be the preferred supplier and the other two are just bunnies making-up the numbers. A seasoned sale person can often sense when the customer isn't serious.

- Do we understand their selection criteria and decision making process? Again, this is a reasonable question that should be asked. However, don't always believe what you are told. Government tenders (for example) will often include an assessment criteria list showing how each criteria will be weighted, possibly cut and paste from their last RFQ. Detailed discussions with the customer will (over time) tease out what they are really looking for and you should develop your own opinion regarding what they see as important. The decision making process speaks to how many hoops and jumps they will take you through getting to the final decision. Sometimes you might find that you have been working at the wrong level. For example, if you determine that the buying team will be making a recommendation to a board or committee higher-up the food chain, and you have identified that your competitor has a strong relationship at that level - then that might heavily influence the outcome.

- Do we have any technical or capability competitive advantages? Clearly, if your technical solution is inferior or much the same as the competition then you will need to develop another basis on which to compete (usually price, business terms, delivery schedule, added-value etc.).

SWOT Analysis

A SWOT analysis is a good tool for summarising the above.

The project feasibility work provides valuable information to inform the solution development and terms and conditions in the final proposal.

An effective solution selling process has a set capture planning process for evaluating each opportunity for the purpose of...

- Assessing the likelihood of bid success

- Identifying the HARD success factors for winning the bid (solution + price)

- Identifying the SOFT success factors for winning the bid (brand and relationship strength vs competitors)

- Identifying project risks (what can't be controlled and the consequences if problems occur)

- Understanding the selection criteria

- Understanding the composition of the buying team and the strength of your brand and relationship against each person, as well as their allegiances and biases toward the likely bidders.

The ideal customer / ideal project

Most firms will have developed an idea of what work they are best suited for, or what type of customer they work best with. The above sample checklist is actually summarised by the concept of the ideal customer.

Having a clear picture of an "ideal customer" (or ideal project) doesn't always mean you can find a perfect match, however what's important is avoiding a perfect mismatch.

Capture Planning/BID or DECLINE?

The final stage of the Capture Planning process is to make a decision to BID or DECLINE.

If proceeding with the bid, the learnings are applied to the bid strategy, proposal and contract negotiations.

Rarely will a capture plan assess the probability of winning as 100%

However, the capture plan should provide the organisation with positive affirmation that chances are HIGH and we have a clear plan for improving those chances through execution of a well thought through bid strategy.

While more commonly thought of as a tool used in large contracting (billion dollar projects), solution selling organisations should apply the same thinking (even if not a fully detailed and exhaustive process) to EVERY opportunity that requires even a few hours of bidding time.

In reality, even the local tradesman quoting jobs has an innate "capture planning" mindset even if only making the decision to not bother (merely asking for a quote is enough to deter many tradies) however, formalising the process provides the following distinct benefits...

- Checklists reduce errors

- Checklists can be continuously improved based on accumulated learnings.

Bidding for projects is costly. Capture planning maximises the value obtained from this resource.

Further reading

Solution Selling - building a better sausage machine

Introduction to capture planning