30 October 2021

Price skimming is the practice of launching a product, service or brand at a high price to maximize profits from early adopters, and subsequently progressively lowering the price to pick-up the laggards.

Riding down the demand curve

When a new product or service is launched, there are always buyers who must be the first to have it. Price skimming is the practice of launching the product initially at the maximum price possible and once the "must have it firsts - or cream buyers" have been skimmed off the top, progressively lowering the price to pick-up the remaining more price-sensitive buyers. This is sometimes called "riding down the demand curve."

The opposite to price skimming is penetration pricing. Price skimming is typically used by technology manufacturers when introducing the new higher specification versions of their products.

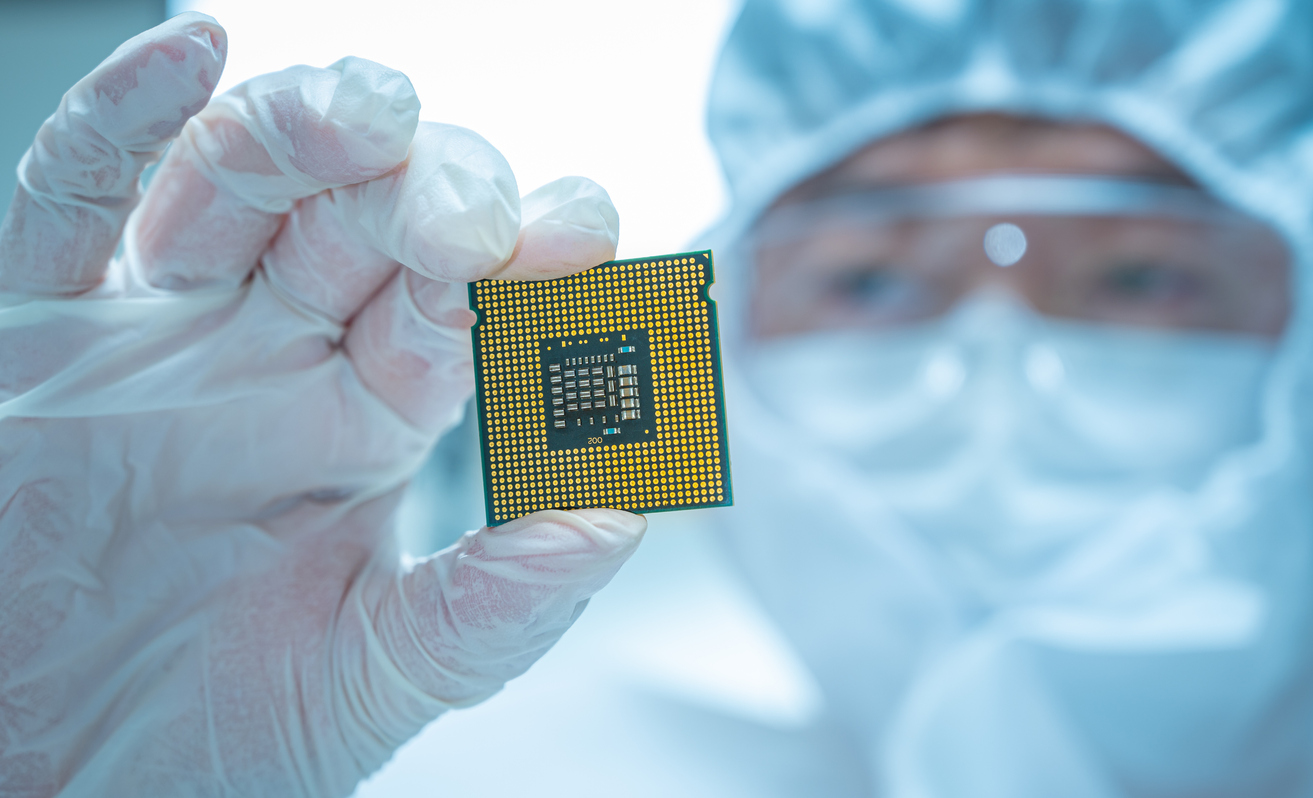

Manufacturers of silicon chips will often launch their latest more powerful versions into the market at a considerable price premium and progressively lower the price over time, knowing that there are always consumers who are prepared to pay for the "latest and greatest." Once these consumers have been satisfied, the price is moved down the pricing tiers until the majority of the market are now buying the product.

This same strategy is used by gaming console manufacturers, flat screen TVs, smart phones, cameras, and other high volume consumer electronics.

Often, the initial launch is accompanied by publicity claiming the new model is in short supply and people are queuing up to buy it. Scarcity is a primary human motivator.

The power of this 'pic of people queuing' is so powerful that one suspects that it might be worthwhile to stage it. Usually accompanied by a talk to camera piece of an enthusiastic consumer saying "I've been in the queue since 7 PM yesterday."

Price skimming maximizes profits as the average price paid for the product over its lifecycle is increased by the early high prices. It also has the advantage of signaling superiority by initially being premium priced.

Thus, the product enters the market positioned as "the best" as indicated by its premium price.

Subsequent buyers who discover the product at its future lower price feel they have bought a bargain. Quite often manufacturers will continue selling the older models (now at lower prices) even when the newer model has been launched.

Price skimming operates on the assumption that there is a relatively finite number of units that will be sold into the market (for example once everyone has an iPhone, sales will start to drop) and that people will wait until the price drops to eventually own one.

Disadvantages of price skimming

Price skimming is not a great strategy in a crowded market particularly if your new model is not clearly superior. Further, that superiority must have perceived value to early adopters. In the computer CPU market, a demonstrably more powerful device promises faster processing speeds which is useful for some applications and for computer hobbyists it provides bragging rights.

Adverse publicity is also a distinct possibility. Consumers are wary of commercial scams and may view initial high prices as simply gouging. They know what you are up to. Too quickly dropping the price may confirm their worst fears. However, in some markets price skimming is so common consumers have come to accept this practice and if the latest upgrade isn't priced high they may suspect that there is something wrong with it. The lesson here is that the marketer must be carefully tuned-in to consumer perceptions.

Managing distribution channels when price skimming

Price skimming requires careful management of distribution channels. Distributors that still have surplus stock bought at the early higher price might find they can't sell against other distributors who have bought new lower priced stock and may be forced to quit the old stock at a loss.

Often, during the early months of a new product launch, distributors may report that they are unable to supply and are waiting for new stock. This might signal that demand has been high. However, sometimes this is because the manufacturer is waiting for the supply chain to clear the initial high priced stock.

This is not an insurmountable problem, but does add complexity to managing channels. Manufactures will sometimes provide fair warning to distributors of an upcoming price drop. However, this sometimes leads to distributors holding off ordering to avoid being caught with higher priced stock.

Managing a price skimming strategy requires careful monitoring of sales orders to detect when the next price drop should be introduced. Done too early, and the opportunity to maximise profits is reduced. Done too late and sales volumes may fall below economic manufacturing output.

Having stock sitting in channels creates a buffer between the manufacturer and the consumer that some times makes it difficult to detect changes in sales volume due to price mismatching with consumer demand.

Have sales volumes declined because distributors have stopped ordering anticipating a price drop, or has the market saturated at the current price?

See? It can get tricky.

This complexity is obviated when manufacturers own their end-user distribution outlets or are prepared to compensate distributors caught with excess high price stock.

Of course, the competitors may launch their "latest and greatest" model during this carefully laid plan and cause chaos. Price skimming requires having a strong brand or a unique offering. It is a strategy most often executed by established market leaders.

Other pricing strategies:

Cost Plus Pricing

Penetration Pricing

Premium Pricing

Price Bundling

Discriminatory Pricing

Yield Pricing

Pricing strategy overview:

Pricing Strategy