06 September 2021

What is industrial marketing (also known as business to business marketing)

It's all called marketing, but selling Coke isn't the same as winning a contract to supply trains

While the majority of marketing is about the sale of branded goods to consumers (so-called b2c or business to consumer) in contrast there are many firms that sell the majority or all of their products or services to other businesses. This category of marketing is referred to as industrial marketing or business to business marketing (or B2B).

There is a third category business-to-government (b2g) which is actually much the same as B2B but has some specific features that make it worthy of a separate category.

Examples of business to business firms and their products and services

An engineering firm designs and fabricates steel structural components used in building construction (office blocks, supermarkets, apartment buildings) or in engineering construction (for example bridges or mineral processing plants). The completed steel structures are bought by building and engineering businesses.

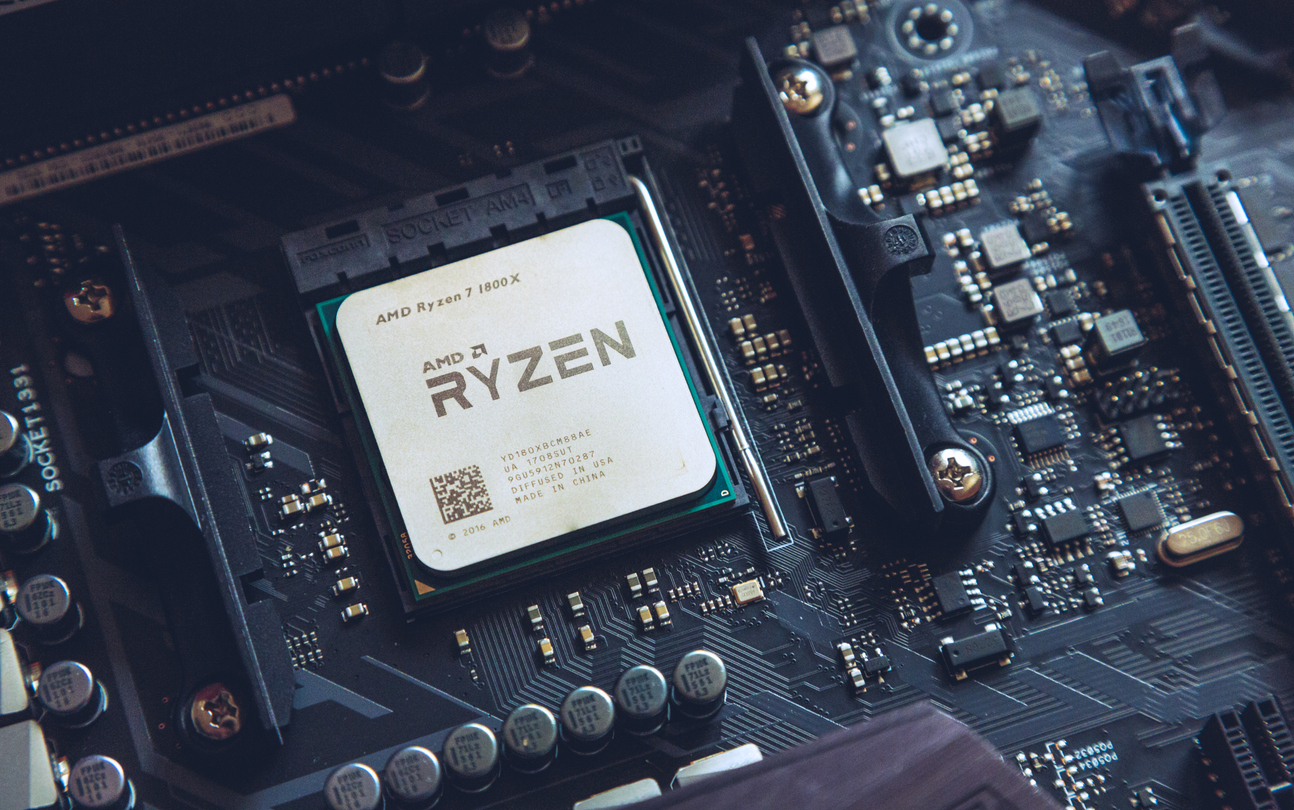

An electronic component supplier designs and manufactures microprocessor chips (for example AMD). These are bought by computer motherboard manufacturers (for example MSI) who fit them to their product and in turn, these motherboards are sold to PC manufacturers.

An architectural firm specialising in commercial buildings sells their design services to building developers and building owners.

An aeroplane manufacturer (for example BOEING) sells a Jumbo Jet to an airline (for example QANTAS).

A professional services firm accountants, solicitors, consultants, advertising and marketing agencies and other creative or knowledge workers.

All of these firms have a need to promote their products and services to existing and potential customers to drive business growth. These are just a few examples of business-to-business (B2B) sales and marketing.

Products and solution selling

Business to business firms (industrial marketers) sometimes sells products where the specification of the product may have been designed to meet the needs of the market but its specification is essentially fixed prior to sale (for example Intel’s microprocessor), semi-customisable (like a jumbo jet where the engine power, cockpit avionics, interior layout and exterior paintwork can be customised to suit the customer’s specification), and completely customisable (also referred to as “bespoke“). The latter category referring to a product that has been designed from scratch according to the customer’s specification or needs.

This introduces the concept of solution selling, where the essential requirement of the business-to-business firm is to sell their solution to the customer’s problem.

Solution selling is particularly interesting because before the seller can propose their solution they must first understand the customer’s requirement and then design a solution, cost it, and finally present it to the customer for their consideration. Where the buyer approaches a number of firms and asks them to compete for the business, the sales process becomes quite complex with each solution provider providing a unique solution and at various prices.

A large proportion of business-to-business selling doesn’t involve a product at all but the sale of a service (for example engineering, architecture, law, accounting these are known as “professional services”). Other examples of services are building services where the final product is a built structure but the services being provided are construction expertise, project management, procurement and building supervision.

The key features of business to business marketing (sometimes referred to as Industrial Marketing) are:

1. Seller and buyer are both businesses

As the name clearly indicates, the first key feature in B2b is that both parties involved in the transaction are businesses.

It’s important to note that “businesses” don’t sell or buy as such (a business is a purely artificial legal entity);

...people actually make the buying and selling decisions

This has two important implications for B2B marketing and the sales process...

- It alters their emotional position; their fears and concerns when acting as business buyers is different than when buying using their own money.

- Width and depth of sales penetration: As a vendor (seller of products or services), the depth of your relationship with an organization is limited to the people working in that organization that you have contact with.

Altered Emotional position

Importantly, corporate buyers are typically not transacting with their own money which provides them with a level of detachment altering their emotional position. However, they are still people and have thoughts, feelings, attitudes, and personal agendas that greatly affect the process.

Even though people involved in purchasing decisions on behalf of their business enjoy some level of detachment , they are not immune to their emotions and prejudices. Their own careers and reputation are at stake. And personalities and power-plays often influence decisions.

Width and depth of sales penetration

It’s commonplace in business to make a statement like (for example) “we do business with Telstra” a company with some 30,000 employees. In reality, most suppliers probably only transact with a handful of key employees at Telstra. A point that becomes very apparent when you are trying to sell to them for the first time (try calling their main number and ask “can I please speak to the person in charge of buying fibre optic cable?“) The receptionist will likely not even know what a fibre optic cable is, or care.

Depth of sales penetration speaks to how far up the food-chain you are dealing. Are you really speaking to the decision makers and key influencers or just the people tasked with running around seeking options?

Width of sales penetration speaks to how many similar types of buyers of your products and services have you established a relationship with? This is particularly important when dealing with large firms running multiple projects each with their own teams. You may have had great success with Team A on their project, but Teams B, C, & D etc. have never heard of you. It's surprising but often they don't swap notes about the vendors they are dealing with. And people develop favorites.

Also people change jobs. Global firms (for example) swap staff internationally on a regular basis sending people to where they are needed. Keeping track of these staff movements is important to maintain your products and services on their consideration list. Knowing "who's who in the Zoo" is a distinct and dynamic B2B sales task.

2. B2B purchase decisions are typically complex

Whereas a consumer purchase is mostly relatively simple (a decision is sometimes made on the spur of the moment), B2B sales tend to be complex often taking months and (for example, Defence Department procuring a warship) even years to make a decision. The buying organisation often writes a detailed specification for the product or service and approaches multiple vendors (business to business suppliers) and requests a proposal (known as an RFP). The buying organisation will carefully evaluate each vendor’s proposal before selecting a successful supplier.

3. B2B purchase decisions are typically high value

The value of the transaction (price for the product or service) tends to be large; sometimes millions of dollars. In business, there are still minor purchases (buying office stationery for example) but for simplicity, we will confine our discussion here to big-ticket items.

4. Multiple people are involved in B2B sales transactions

There are often multiple people involved on both sides of the transaction. On the selling side, there is usually a team of people involved in selling and delivering the product or service. On the buying side, there can be multiple people involved in the decision making process who are usually well-versed with market pricing and specifications. Also, due to constant monitoring of the market, these buyers would have an excellent knowledge of the products and/or available solutions. In most cases the purchases are specification-driven.

The level of complexity of the purchase decision (which increases with the value and potential business impact) necessitates the input of more people. Typically these people fall into categories:

- Technical buyers: people whose main focus is understanding the technical specifications and performance characteristics of the proposed purchase.

- End-users: these are the people who will end up applying/operating the purchased services/equipment/item being purchased and maintaining it.

- Economic buyers: people who are concerned primarily with the financial impact of the purchase (how will we pay for it? can we afford it? is this the best use of our funds at this time? what is the financial return from the added capacity/utility of the intended purchase?)

- Procurement people: these are specialists responsible for managing the procurement process. They will be focused on ensuring the purchasing process has been run properly and that all available options have been explored and vendors have been coerced into submitting their lowest price while still meeting or exceeding the specification. Another important consideration is financial capacity and survival - is the vendor capable of funding the project between progress payments and what is the risk of their business failing during the contract and/or will they still be around to support the product post-sales during the serviceable life of the product? For this reason quite often the lowest bid is not always the smartest option particularly if it is suspected the bidder has low-balled their offer.

- Decision-makers: usually at the top of the food chain, these people (or person) will have the final say based on the recommendations put forward to them by the above people. Some purchasing decisions require not just CEO approval but also board approval, and even external financier approval. Things can get particularly complicated for government purchases when departmental, national, or international politics come into play.

One person (or multiple) may exist in each category and some people may have overlapping roles. In addition, some of these roles may be provided by external advisers (brought in specifically to advise on this procurement project).

Business to business requires more personal interaction

B2b marketing relies heavily on one-to-one customer relationship building, through personal interaction, requiring sophisticated sales management and an educated, knowledgeable, trained staff whose words and actions are aligned with corporate brand objectives.

Most b2b selling is best-achieved face-to-face for many reasons;

Firstly; it aids in understanding the buyer’s true needs and underlying motivations (beyond the formal specification) providing valuable insight into how to shape the product or service being offered (solution selling) to achieve a competitive advantage. The importance of this can't be overstated. The customer's real motivation and true needs are often not well articulated in a RFQ/Tender specification because: It's time consuming to draft, the author might not be brilliant at writing, but most importantly specifications will change during the pre-sales process as the customer speaks to more vendors, gains a better understanding of the potential solutions and costs, and the business environment changes. The bidder that fails to stay close to the buying team and continues to rely on the original specification may not detect these changes.

Secondly, it establishes trust which is important in the sale and delivery of complex products and services where often there is the considerable fine-tuning of the final product or service being purchased. Further, the delivering of solutions often runs into unforeseen problems; trust between the parties (usually established through working on previous projects) enables collaboration to solve the problem without getting too hung-up on minor commercial consequences. This is a real issue in building contracting where unforeseen problems are leveraged by the contractor to claw back profits given-up in order to win the project by submitting a lower priced bid ("low-balling").

Thirdly, it is critical for the seller to understand the decision-making process and to identify the roles, personalities, internal and external allegiances of the people involved in the buying decision. The biggest rookie mistake in B2B selling is not dealing with the true decision makers. Old B2B jungle saying "Never accept 'NO' from someone who doesn't have the power/authority to say 'YES'.'"

For the buyers, meeting the selling organisation’s personnel (often referred to as a vendor) provides an opportunity to evaluate their capability. However, many business-to-business transactions involve a complex interplay of people, and when people get together invariably personal relationships and politics come into play.

This has seen the emergence of procurement specialists whose primary role is to ensure that the procurement process is stripped of the human factor and the decision is based purely on logic and fair play. Good luck with that.

Corporate brand loyalty more so than product brand loyalty

Brand loyalty is different than in consumer goods markets. Corporate brands are usually more important to b2b buyers than product brands. While practical purchase criteria drive product selection (e.g. product performance, capabilities, price), the value b2b buyers place on the corporate brand drives and complete the actual purchase decision – “can I believe in this company? can I trust them? will they deliver what they promise?

Companies seek long-term relationships knowing that any experiment with a different corporate brand comes with risks that can impact the entire business. This is not to say that buyers do not seek competitive offers from a number of different vendors but generally they approach a select pool of vendors who have a solid reputation (another way of saying a strong brand) in the product or service category.

Equally (and this particularly true of SME’s) many businesses prefer to continue to deal with the same suppliers because it reduces the procurement workload; running tender processes is time-consuming and expensive for both the buyer and seller.

This tendency to not always test the market can have complex effects; sometimes it is an opportunity to talk the customer out of a formal tender process and instead encourage them to negotiate a contract. However, more often than not the buyer relegates smaller procurement decisions to items that have less impact on their business and tend to just continue using the same supplier (assuming they are performing well enough).

This becomes a major challenge if you are a supplier of products and services that consistently fall into this category. As an example, consider the multitude of buying decisions that a high volume residential construction company needs to make. Would they be bothered changing supplier for items that cost less than $500 per home? It's not their biggest problem to solve.

B2b marketing taps into different buying emotions

As hinted at earlier, B2B marketing is not without emotion.

While B2B prospects are generally not buying on impulse , they do have personal motivations.

For example, the fear of making the wrong decision, the level of confidence in the proposed solution (will it work? Is this the best value for money option? Will the vendor still be in business by the time the product or service is delivered?) The level of trust established in the seller’s people is also an important consideration (and when selling professional services, the main consideration).

While different to consumer marketing there exist very real emotional motivators in the B2B world. Consequently, frivolous advertising claims have less credibility in b2b selling and a higher level of due diligence takes place on the buyer’s side to ensure that the vendor has the capacity and capability to deliver. But of critical importance is the old selling maxim “sell yourself first, your company second and your product last” – which is another way of saying that the vendor’s sales team need to come across as credible.

But, don’t be mislead into believing that all business-to-business transactions are always logical.

Occasionally (for example) internal power struggles take place between individuals or departments and battles of wills and egos results in the purchasing decision being based on who has the strongest personality rather than what is right.

Some people will take it personally if the purchasing option that they have been advocating and promoting is not selected; they will see it as a slap in the face, a loss of credibility, and a blow to their career aspirations. Things can get silly.

Purchasing decisions can have political consequences; look at the current battle regarding Australia’s need to upgrade its submarine fleet. And occasionally, sometimes shortly after a major contract has been let, magically a new swimming pool appears in the backyard of one of the people involved in the purchasing decision.

Graft and corruption is a potential challenge in high-value business to business purchase decisions particularly when it is illegal (and it usually is), however, it becomes doubly interesting when dealing with countries where corruption is a way of life. Many Western corporations (and Governments) live with the reality that in order to close a contract with a foreign entity, local officials have to be paid off. Officially, everyone denies it happens. Unofficially everyone denies it happens. See? it gets interesting. These unofficial non-existent bribes even have a polite term to describe them - "informal tariffs."

Public service departments and/or Authorities being pushed to win lucrative trade deals so that Ministers can report a significant win to the voting public walk a fine line between public disgrace and admiration. Paying-off corrupt officials will close the deal vs the almost certainty of losing the contract if they don't. And it gets far more complicated than that.

B2G - selling to governments

Attempting to win a large government contract is inevitably a step into a surreal world; the larger the contract, the more surreal it can become.

Key modifiers, of what should be straightforward "fair-play" assessments of the best value for money and minimum risk, can be...

- Politics: usually pork-barrelling, a term used to describe shoring-up or influencing voter support by dropping a large project into a marginal seat. However, large donations to political parties are often used to enable large companies to later call in favors when large government contracts are let.

- Inter-agency rivalry: a difficult topic, because referring to a specific example would be courageous. Suffice to say, some Government departments or agencies don't like each other and/or are competing for resources (funding) or just plain power and prestige. It happens.

- International diplomacy: Where vendors for significant contracts are large global players, it is not unusual for high-level pressure from senior members of governments from the bidding country aimed at the buying country to try to kick the deal over the line. A flurry of last-minute lobbying, telephone calls, secret meetings and side deals is typical shortly before the final decision is made.

- Influencing key decision makers: In popular fiction (novels and movies) Government officials are portrayed as often having their decisions swayed in favor of one bid over another. Such influence can range from promises of lucrative board positions or consultancies post political career to down right bribery or blackmail. This never happens in real life. Or does it?

Some corporates are very good at playing this game and others have a policy of staying well clear of bidding for government contracts because they aren't. However, very few billion-dollar projects take place without government money being part of the picture. Assessing the political landscape features prominently during capture planning.

Bizarre outcomes are more the norm than the exception.

However, it is also true that the unsuccessful bidders and/or political rivals sometimes spread disinformation after the decision in an attempt to smear the reputation of the government, to salvage corporate image by providing an excuse as to why they didn't win the prestigious tender, or just sour grapes.

It is also true that the technical complexity behind decision making can be both difficult to understand for the uninitiated and isn't newsworthy.

The final decision may well be the right one, but who would know? The media are particularly poor at presenting a balanced view of such events usually focusing more on the sensational aspects rather than a careful dissection of all factors, particularly when there is vested interest in making sure the real story doesn't see the light of day.

But, the truth is the vast majority of government dealings with the private sector are honest, straight-forward, and transparent. As it should be.

Overwhelmingly, the best observation to make about dealing with government is that they are highly risk adverse, so tend to buy from the vendors with the strongest brands.

Multiple paths to market

A high proportion of business to business selling is a direct sale i.e. the vendor (the selling organisation) interacts directly with the buying organization. For other b2b organizations, the “seller-to-end-user” relationship is not exclusive or direct.

Channel strategies may be required as many b2b companies gain more effective market reach by selling through distributors, dealers, independent representatives, outside consultants, specifiers (e.g. consulting engineers and architects), system integrators, and other supply-chain partners all of whom require specific sales attention and the development of tailored channel marketing strategies and the building of relationships.

Fewer customer targets

In many cases, the number of organisations who are likely to buy (are in the market for) the product or service being offered by the business to business seller is comparatively small. In some cases less than 1,000 or so firms and for highly specialised items numbering less than 50. Take for example the global market for aircraft manufacturers like BOEING, there may be only 100 or so airlines in the world that have a need or the financial capacity to purchase their aircraft. Many businesses to business organisations have even less actual customers (as distinct from possible customers) at any one time.

Defence contractors in the US often have only one customer - the US Government (or more accurately, the Department of Defence).

Typically, many organisations operating in the b2b space may only have a handful of customers one of which may comprise the majority of their annual sales revenue.

The fact of a limited customer base has both advantages and disadvantages. The organisations comprising the component supply chain to the Australian car industry (when we had one) enjoyed a relatively captive market for decades having four customers – Ford, Holden, Mitsubishi and Toyota. Having fine-tuned their manufacturing, human resource and business processes to efficiently meet the very special needs of their few customers they faced an insurmountable task finding new customers when car manufacturing ceased in Australia.

Direct selling is the dominant promotional technique

Business to business marketers typically is less reliant on mass marketing techniques such as television, radio and press advertising where the ability to reach many hundreds of thousands of viewers is possible but not required. Such advertising would have a very low return on investment for the business to business marketers who only have a very small number of customer target organisations many of whom they would probably know by name (or could find out soon enough with a bit of digging around).

The implications for the promotion mix selection are that firms who sell business to business tend to rely heavily on direct selling (i.e. using people who have a sales role) and use other promotional techniques to support this function; lead generation activities through “networking” and digital marketing techniques are often used. Trade shows and exhibitions are also used to not only gain brand awareness but also to facilitate meeting potential buyers. Other important sales tools are technical data sheets and specification folders…

The increasing importance of websites in industrial selling

These are increasingly being published online and one of the most important promotional tools is website design which potential customers are using more and more to locate products and technical solutions as well as to gauge the pedigree and credibility of the firm. A sub-optimal website is now tantamount to professional suicide.

A modern trend in business to business websites is the use of purchasing portals, particularly for the management of supply contracts for minor purchases. A good example is parts and consumables. A buying organisation may identify (say) 50 small value items they frequently purchase, writing out a purchase order every time they need a handful of small items is costly. Instead, they will negotiate a 12-month contract for the 50 items specifying the annual total volume of supply anticipated. Vendors would bid for the 12 month supply contract. Vendors specialising in this space will gain a competitive advantage if they can provide an online portal via which their customers can order the contracted items.

Business to business marketing is a unique

B2B is a specialised subset of general marketing and succeeding in this space requires specialised knowledge and experience.

Further reading

What is solution selling

What is industrial marketing

Solution Selling - building a better sausage machine

Introduction to capture planning

An example of an online sales portal. - one we built for Oliver Technologies.